Investment Options in South Africa

Explore the diverse range of investment opportunities available in South Africa. From traditional options to modern financial instruments, there's something for every investor looking to grow their wealth.

Stocks

Invest in shares of South African companies listed on the Johannesburg Stock Exchange (JSE). Benefit from the growth of local businesses and potentially earn dividends.

Bonds

Consider government bonds or corporate bonds for a more stable investment. These fixed-income securities offer regular interest payments and return of principal upon maturity.

Unit Trusts

Invest in professionally managed funds that pool money from multiple investors. Unit trusts offer diversification and are suitable for both novice and experienced investors.

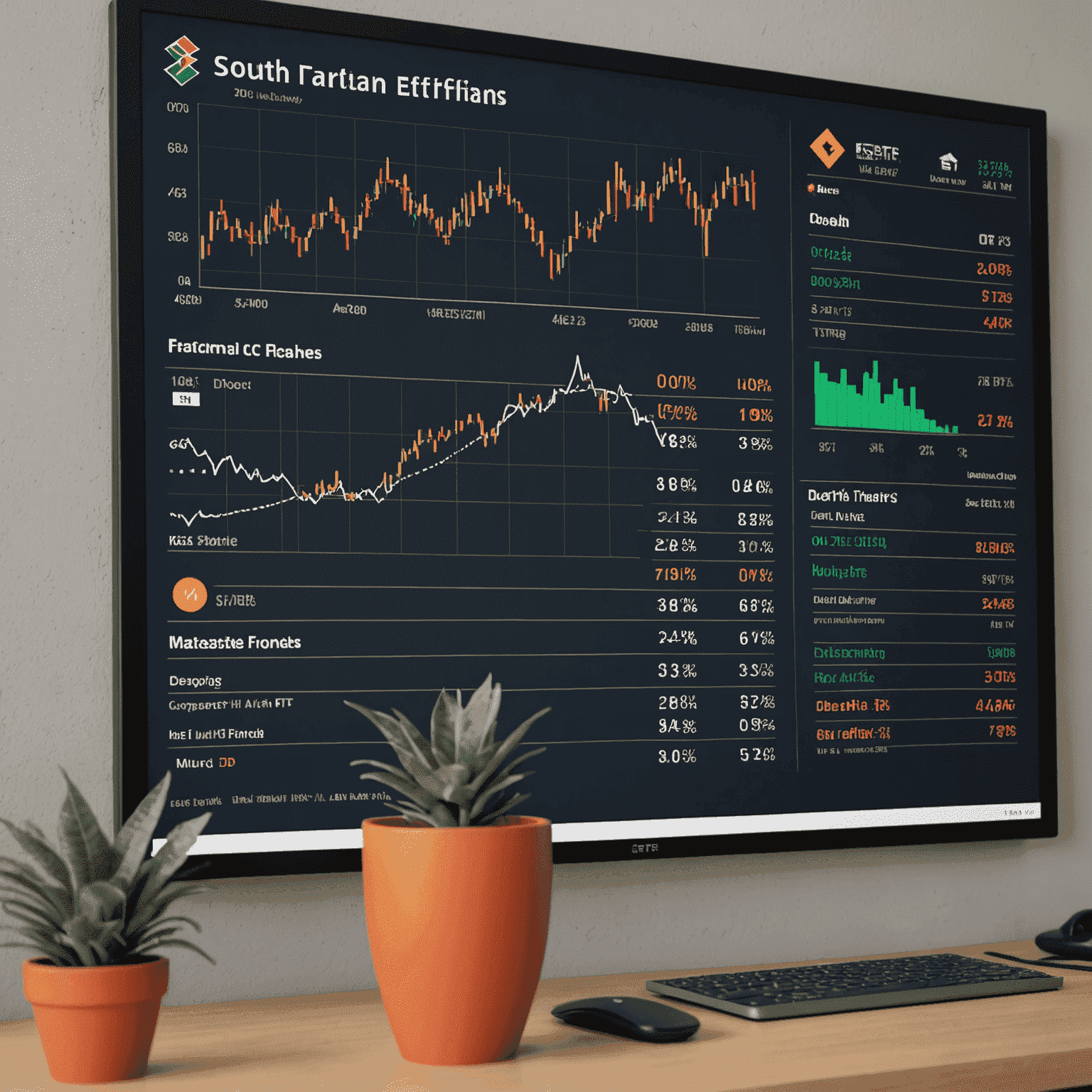

Exchange-Traded Funds (ETFs)

ETFs track indices, commodities, or baskets of assets. They offer the diversification benefits of mutual funds with the trading flexibility of stocks.

Real Estate

Invest in physical property or consider Real Estate Investment Trusts (REITs) for exposure to the South African property market without direct ownership responsibilities.

Retirement Annuities

Plan for your future with tax-efficient retirement annuities. These long-term investment products offer tax benefits and help secure your financial well-being in retirement.

Remember:

Diversification is key to a balanced investment portfolio. Consider spreading your investments across different asset classes to manage risk and potentially enhance returns. Always consult with a qualified financial advisor to make informed decisions based on your personal financial goals and risk tolerance.